Build insurance workflow software, no code required

Streamline claims, manage policies, and enhance efficiency with a customizable workflow tool tailored to your insurance team.

Customize your insurance workflow

Choose only the steps and features your insurance process needs. Tailor your workflow now, and adapt it easily as your requirements change.

Unify your insurance data in real time

Connect spreadsheets, policy management systems, and claims tools with real-time sync—or manage everything in Softr Databases. Create a single source of truth for your insurance workflows.

Custom access for every team. Built-in security, no dev time.

Empower your insurance team with secure, tailored access to workflows, claims, and approvals. Set up logins, user groups, and permissions—no IT help needed.

Advanced permissions

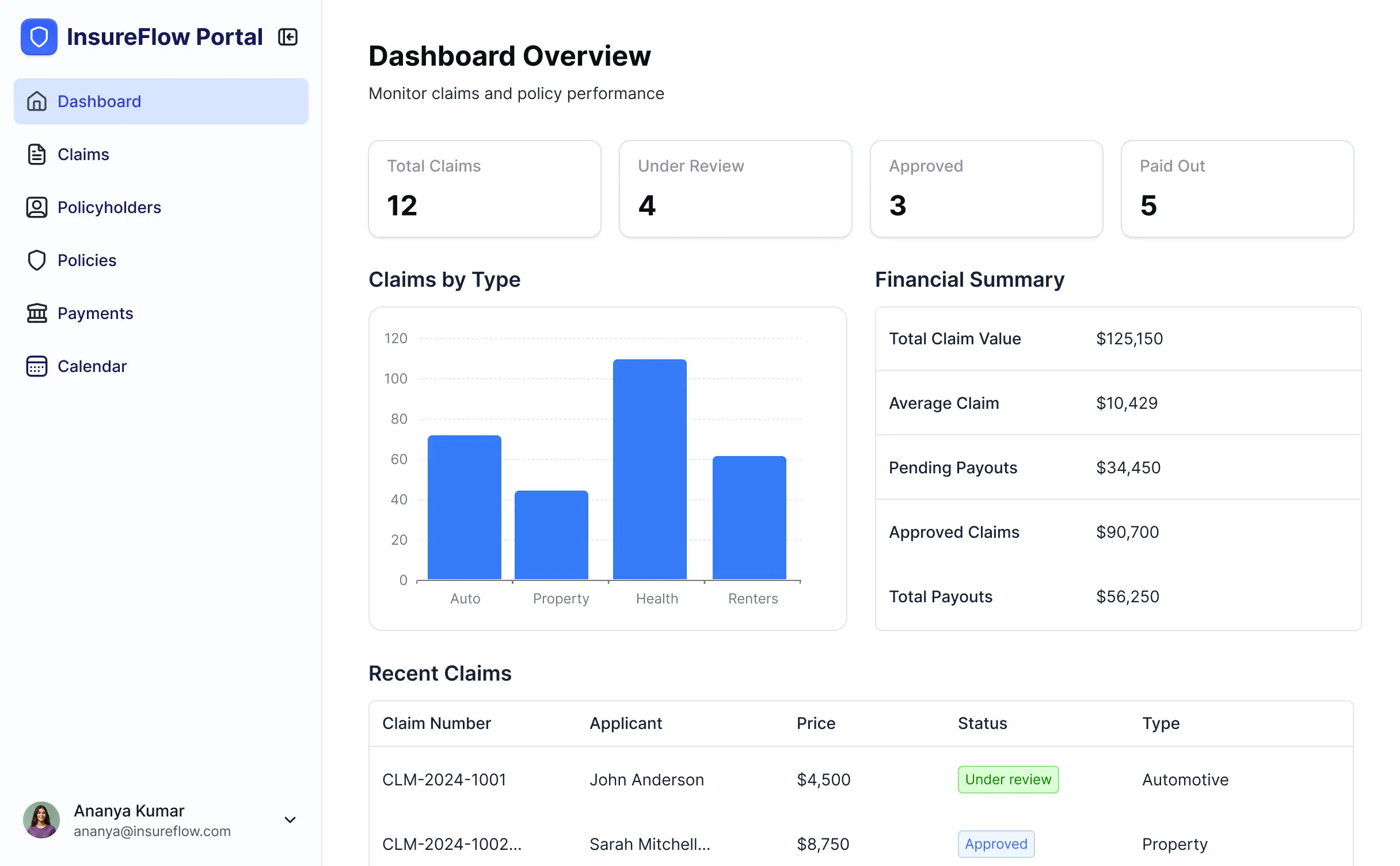

Give adjusters, agents, and managers custom dashboards, so each role gets the tools and data they need.

User groups

Give adjusters, agents, and managers custom dashboards, so each role gets the tools and data they need.

Automations

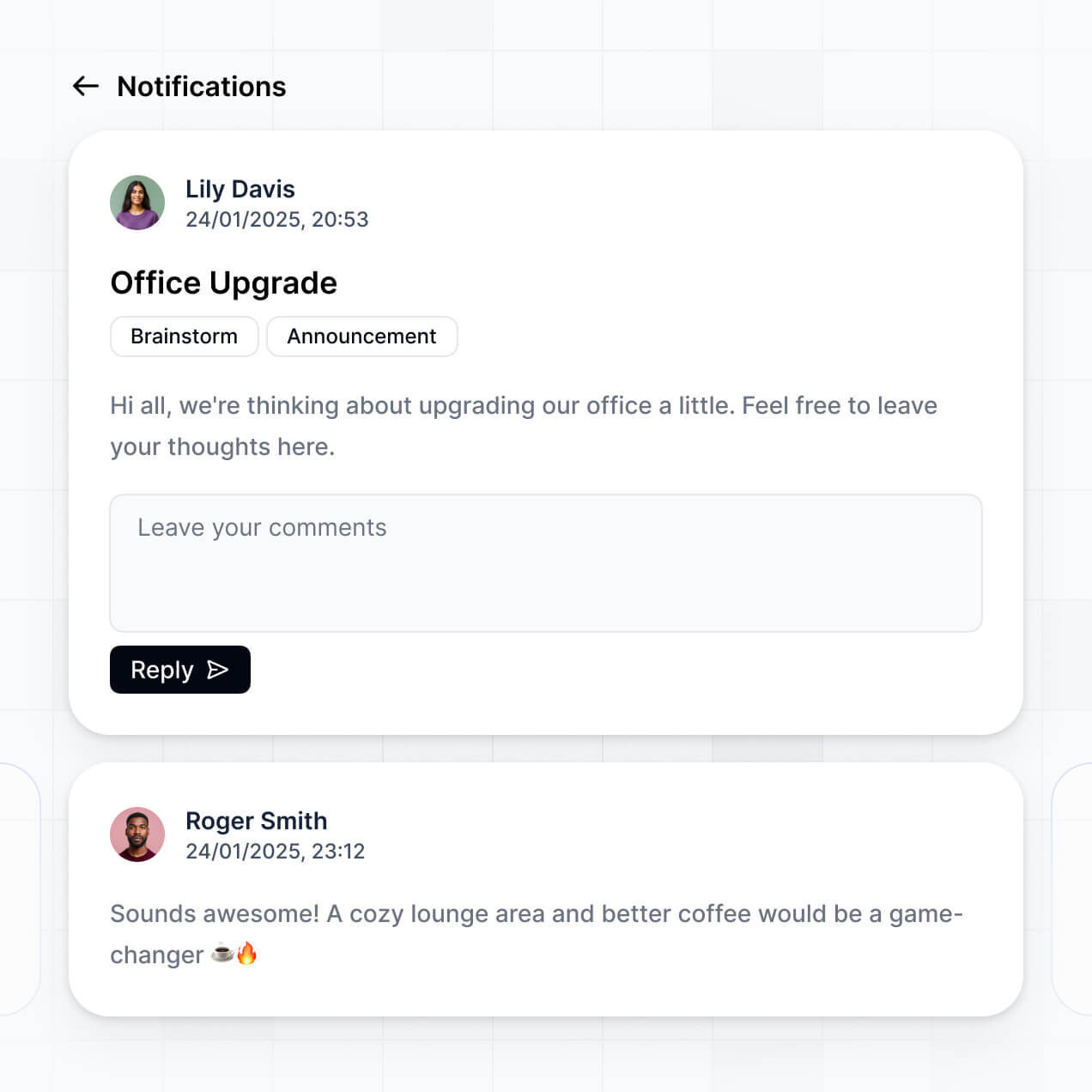

Connect with tools like Make or Zapier to automate claim assignments, follow-ups, and routine updates.

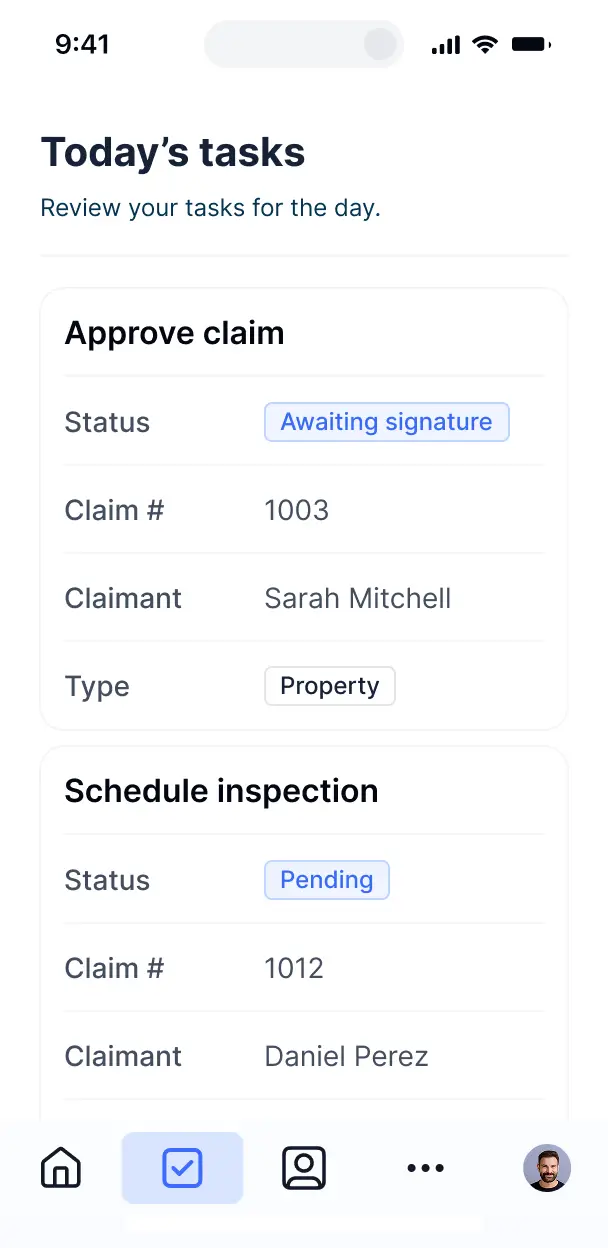

Works on any device

Access insurance workflows and client records from any device. All apps are mobile-ready out of the box.

Easy, secure logins

Enable your insurance team to log in securely with Google, email, or SSO—no IT requests needed.

Security

Keep sensitive policy and client information protected. Softr is SOC2 and GDPR compliant with robust access controls.

.svg)

Give insurers an AI teammate

Let your team ask AI about claims, policies, or tasks—answers appear instantly within your insurance workflow system.

Why Softr vs other software

No more one-size-fits-all tools or costly custom builds. Softr is easy to use and fully customizable, so you can launch faster, adapt as you grow, and skip the complexity of traditional software.

Easy, fast setup

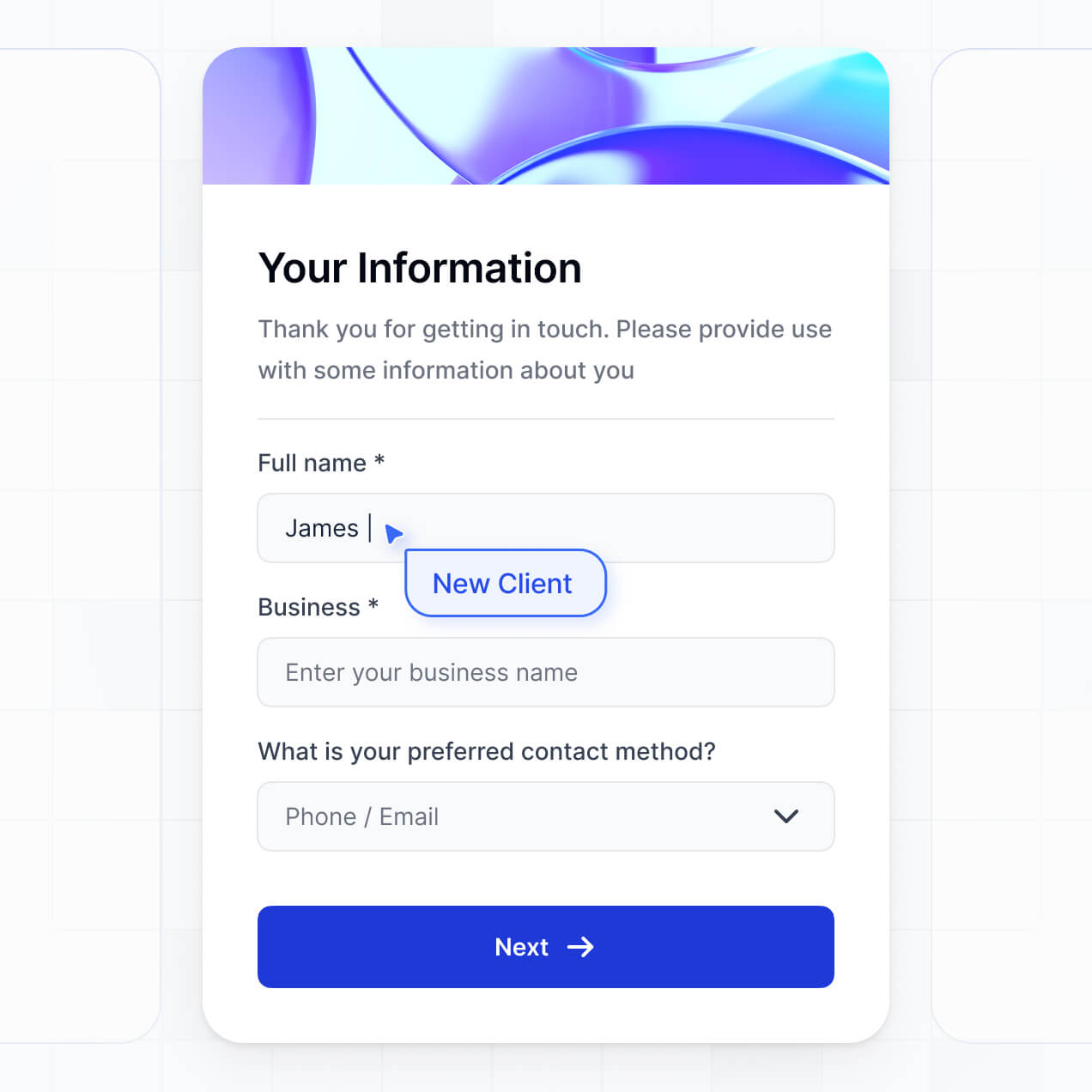

Set up your insurance workflow tool in minutes using drag-and-drop blocks and ready templates.

Consolidate your stack

Easily add new processes, forms, or reports as your insurance workflows change—no rebuild needed.

Flexible as you grow

Manage claims, policies, and team dashboards—all in one place, with no extra tools or logins.

Build a fully custom insurance workflow in minutes

Connect to your data in seconds

Integrate with your spreadsheets and databases, including Airtable, SQL, Hubspot, Google Sheets, Supabase, BigQuery, and more—in just a few clicks. Your data is always secure and in sync.

Customize layout and logic

Drag and drop customizable building blocks with various views and functionalities. Granular permissions allow you to control what data each user can access, and which actions they can take.

Publish and launch

Ship applications that your team will love in minutes or hours, instead of days or weeks. Deploy on both desktop and mobile.

250+

600+

Frequently asked questions

Insurance workflow software is a secure online platform where insurance agencies, brokers, and their clients can log in to manage policies, submit claims, access important documents, and track the status of applications or renewals. It centralizes all your communication and paperwork, eliminating the need for back-and-forth emails or spreadsheets. This makes it easier to stay organized and ensures a smoother, more professional experience for both your team and policyholders.

Softr makes it simple to build insurance workflow software tailored to your agency’s needs. You can connect your current data sources—like Airtable, HubSpot, Notion, monday.com, SQL, and more—and create a platform where your team and clients can log in, check policy updates, fill out forms, upload claims, and access policy documents, all in one place.

No coding is needed. You can start with a template or build from scratch, customize the look and feel, set up user permissions, and brand it for your agency. It’s fast to launch, easy to update, and flexible enough to grow as your insurance business changes. This helps keep everything organized and gives your clients a polished, streamlined digital experience.

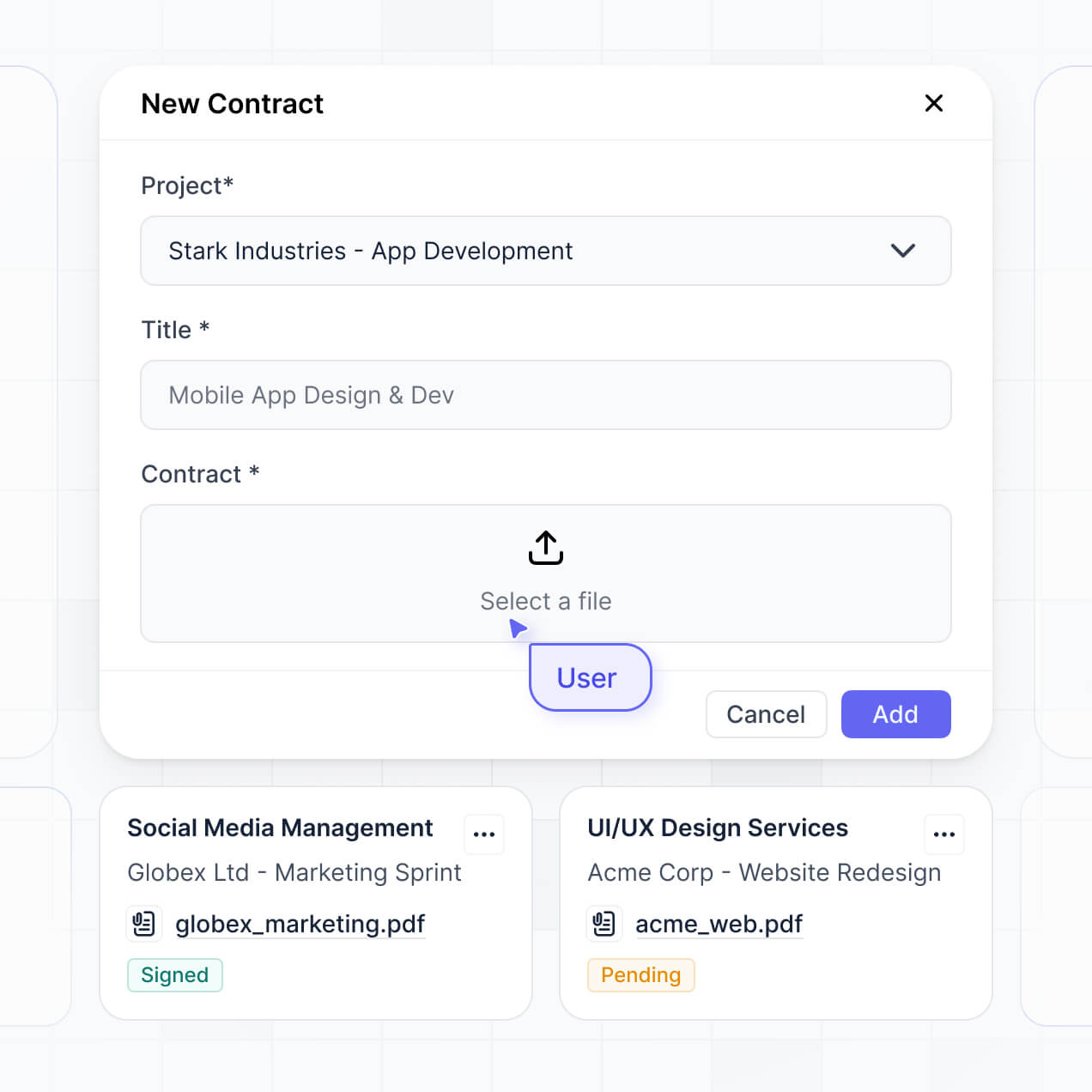

You can include a variety of features in your insurance workflow software, depending on your agency’s process. Some common options include:

\- User logins – so each client or agent can access their own policy information

\- Custom dashboards – to display policy status, claim history, or renewal reminders

\- Forms – for policy applications, claims submissions, or feedback

\- File sharing – clients can securely upload and download insurance documents

\- Search and filters – to help users quickly find policies, claims, or documents

\- Tables, lists, and detail views – to show tasks, renewal dates, or claim progress

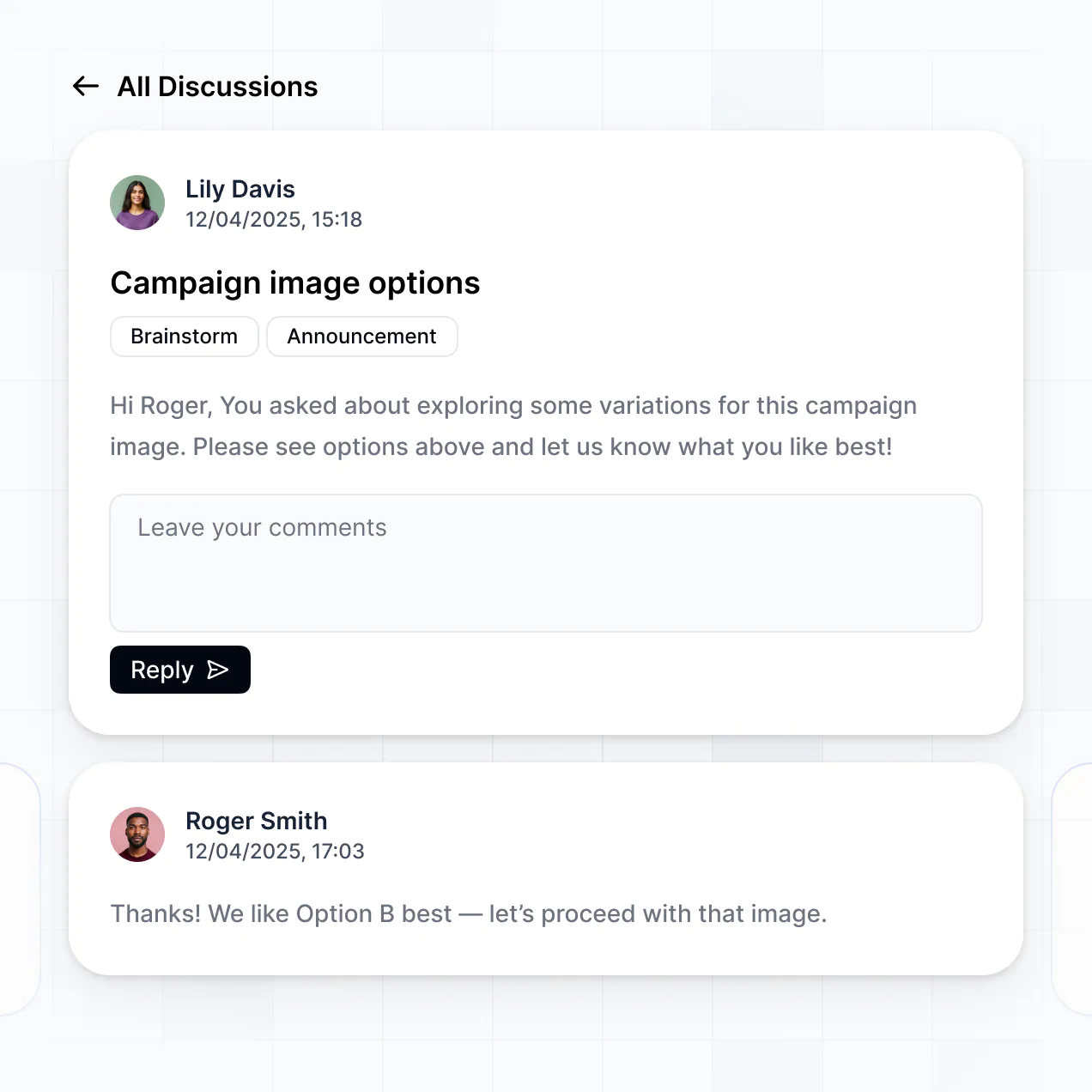

\- Comments or status updates – to keep all communication organized

\- Charts – to visualize claim trends, renewal cycles, or portfolio metrics

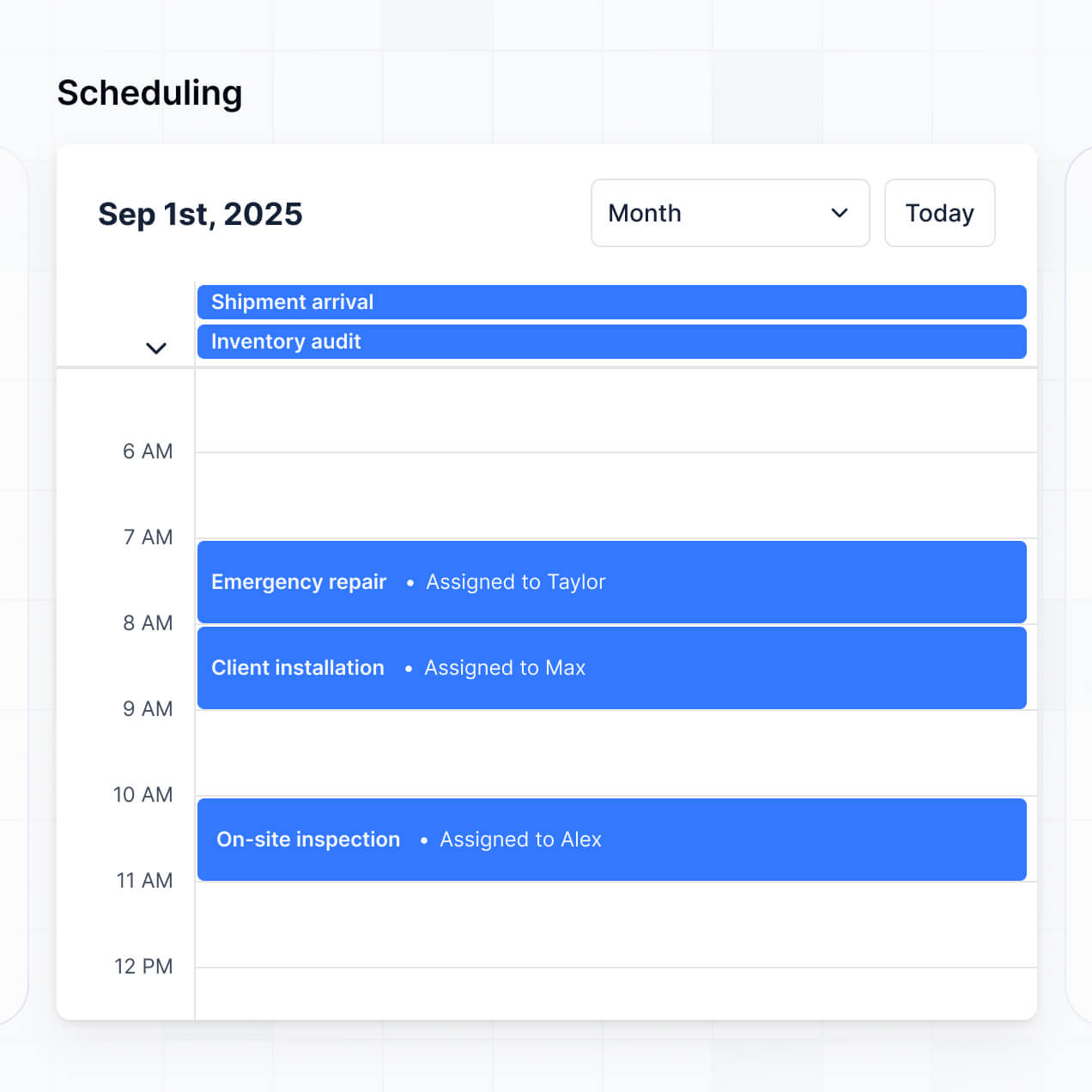

\- Calendar view – for important deadlines, renewal dates, or meetings

\- Permissions and roles – so agents, underwriters, and clients only see the data relevant to them

All these features can be built using Softr’s drag-and-drop blocks—no coding required. If your workflow changes, updating your platform is quick and easy.

No coding is required. You can build your insurance workflow software entirely using Softr’s visual editor. Everything from layout and workflows to user permissions can be customized without writing a single line of code.

Yes. You can manage multiple policyholders, agents, or teams within a single insurance workflow portal. Each user only sees the content and policy data assigned to them, based on their login and role. This is particularly helpful for agencies or brokers who handle multiple clients or internal teams and need to keep information organized and secure.

Softr supports a wide range of data sources, making it easy to integrate your insurance workflow software with the tools you already use. You can connect to Airtable, Google Sheets, Notion, Coda, monday.com, HubSpot, Clickup, Xano, Supabase, PostgreSQL, MySQL, SQL Server, MariaDB, BigQuery, and more. If you use other insurance management systems, you can bring in that data using the REST API.

You’re not limited to one source. You can pull in policyholder data from, for example, Airtable and lead information from HubSpot at the same time. Most integrations support real-time, two-way sync, so your insurance workflow portal and external data sources stay up-to-date automatically.

Yes, Softr gives you full control over how users interact with your insurance workflow portal. You can tailor the layout, navigation, and content to fit your agency’s processes and branding. Each page or section can be shown or hidden according to the user’s role—so policyholders, agents, and admin staff see only what’s relevant to them.

You can set up different roles, such as agent, underwriter, or policyholder, and define exactly what each can view or update. For example, clients can review only their own policies and claims, while agents or managers have broader access to manage all records. You can even filter data so that every logged-in user has a personalized dashboard.

This level of customization ensures your insurance workflow portal remains secure, efficient, and tailored for every user’s needs.

Yes, you can. You don’t need to have existing insurance records or data in another tool to start building your workflow portal with Softr. If you’re starting from scratch, you can use Softr Databases, which is built into the platform and integrates perfectly with any insurance workflow you create.

But if you already have client or policy data in systems like Airtable, Google Sheets, HubSpot, Notion, Coda, monday.com, Supabase, or SQL, you can connect those as well. There’s also a REST API connector to bring in data from other insurance software or CRMs. This way, you have full control over how your insurance workflows are structured and displayed.

Yes, you can fully white-label your insurance workflow software in Softr. You can use your agency’s logo, brand colors, custom fonts, and your own domain to ensure the software aligns seamlessly with your organization’s identity. All Softr branding can be removed, so agents and policyholders only see your company's branding throughout their experience.

Absolutely. Softr allows you to tailor both the design and layout of your insurance workflow software to fit your needs. You can modify colors, fonts, spacing, and the structure of each page to match your agency’s brand. Arrange pages as you like, choose which blocks appear where, and set up different views for underwriters, agents, and policyholders when they log in.

To present your data, you can add various types of blocks based on your workflow:

\- Table blocks – to display policy lists, claims, or customer details

\- List or Card blocks – to highlight client profiles, policy documents, or claims in process

\- Detail View – to show a single policy, claim, or customer record at a time

\- Forms – for submitting new claims, policy updates, or customer inquiries

\- Charts – to visualize claims trends or renewal KPIs

\- Calendar blocks – to track renewals, review dates, or claim deadlines

If your workflow changes, you can easily update the design and content right in Softr’s visual editor.

Softr is designed with security at its core. All data in your insurance workflow software is encrypted during transit (TLS) and at rest, and your platform is hosted on secure, reliable infrastructure. You have full control over user permissions within the app—set role-based access for agents, underwriters, and clients, manage visibility rules, and apply restrictions to safeguard sensitive insurance information.

For apps connected to external data sources like Airtable, Notion, or SQL, Softr does not store your data—it simply displays it in real time according to your access configuration. You always control who can view or edit policy, claim, and customer data.

Softr follows industry best practices for authentication, access control, and ongoing platform monitoring to keep sensitive insurance data safe.

You can start building your insurance workflow software on Softr for free. The Free plan lets you publish one app with up to 10 users and 2 user groups, supporting all standard data sources like Softr Databases, Airtable, and Google Sheets.

If your insurance software needs to support more users or advanced features, you can explore Softr’s paid plans: <http://softr.io/pricing>

Softr is focused on enabling you to build robust, user-friendly software for insurance workflows without writing any code. What stands out is how quickly you can go from concept to a working insurance solution, with strong integration to your preferred data sources.

While other no-code tools might prioritize building mobile apps or require more technical expertise, Softr is great for teams who want control over layout, user experience, and permissions—perfect for insurance agencies managing policies, claims, and customer data. You can create secure, branded portals for agents, underwriters, and policyholders, all connected to real-time data.

You can customize every aspect visually—from process steps to data visibility. With built-in features like user roles, forms, conditional logic, and API support, you don’t need to stitch together multiple tools to create a polished insurance workflow solution.

Yes. Softr provides a variety of integrations so your insurance workflow software can connect with the rest of your tech stack. You can integrate with tools like Stripe for payments, Intercom for support, and automate routine tasks using Zapier, Make, or N8N. Softr also supports REST API and webhooks for custom workflow automation.

Whether you want to automatically create a new task when a claim is submitted, send status updates to other systems, or pull policy data from your CRM, you can easily automate these processes within your insurance workflow software—no coding required.