Build your own crm for insurance brokers, no code required

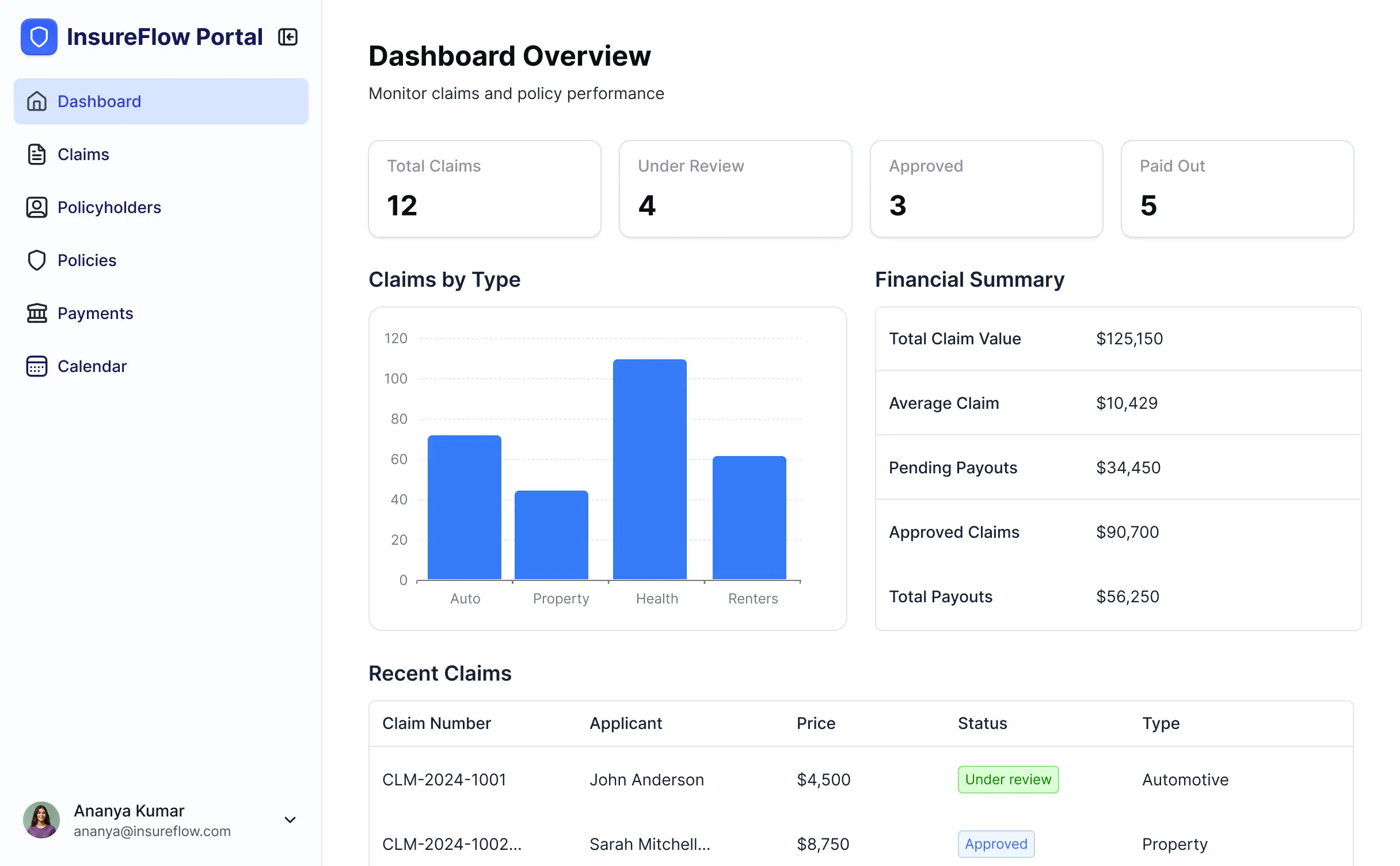

Manage client relationships, track policies, and streamline workflows with a fully customizable CRM tailored for insurance brokers.

Customize your CRM around your processes

Create an insurance CRM with the workflows and features your team needs. Add or adjust views as your business evolves—no coding required.

Unify your client data in real time

Connect spreadsheets, CRMs, and policy management systems with real-time sync—or manage everything in Softr Databases. Create a single source of truth for your insurance business.

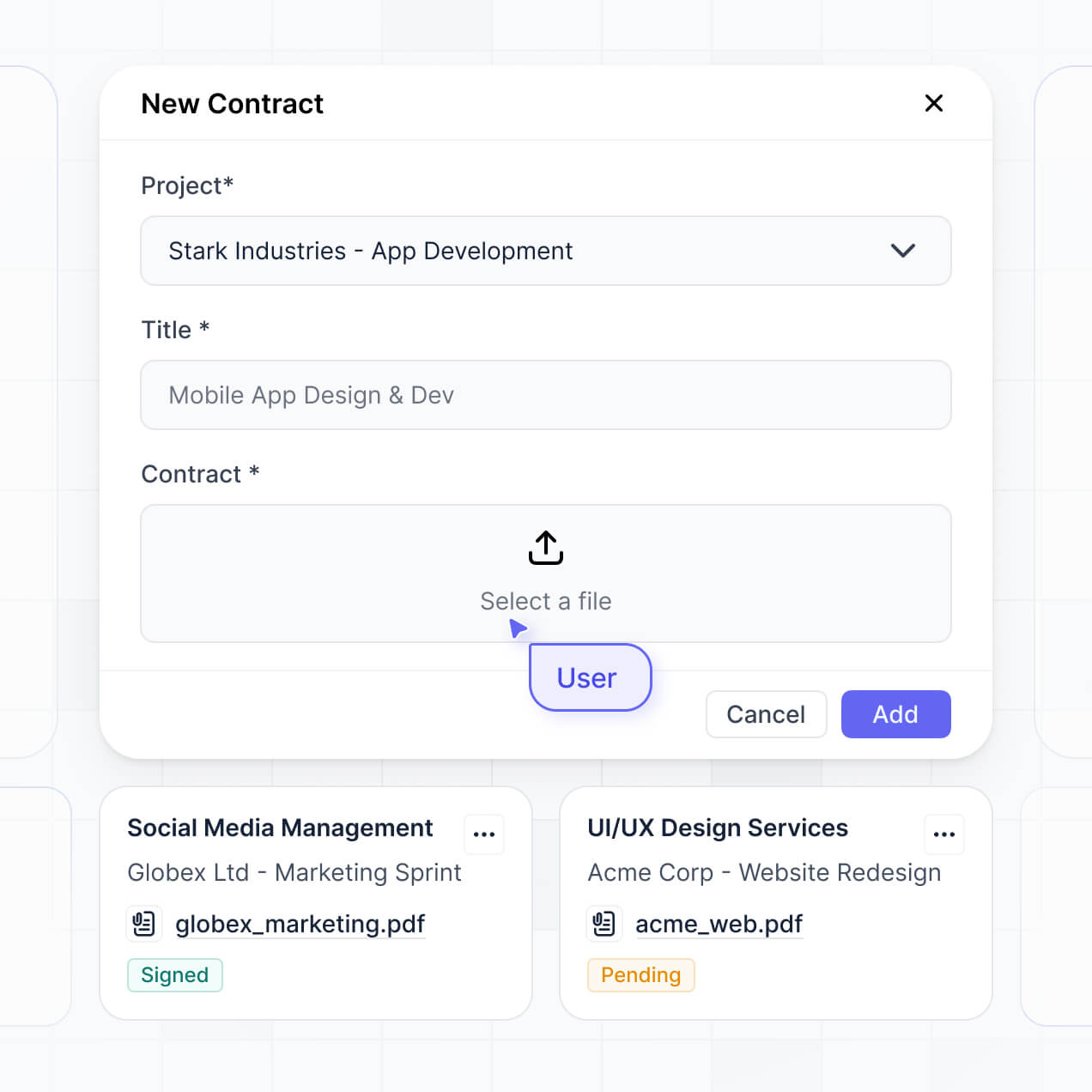

Custom access for every broker. Built-in security, no dev time.

Equip your insurance team with tailored access to client and policy data. Set secure logins, user groups, and permissions—no IT help needed.

Advanced permissions

Give each broker, manager, or support staff a personalized dashboard with just the info they need.

User groups

Give each broker, manager, or support staff a personalized dashboard with just the info they need.

Automations

Connect your CRM with tools like Make or Zapier to automate follow-ups, renewals, and reminders.

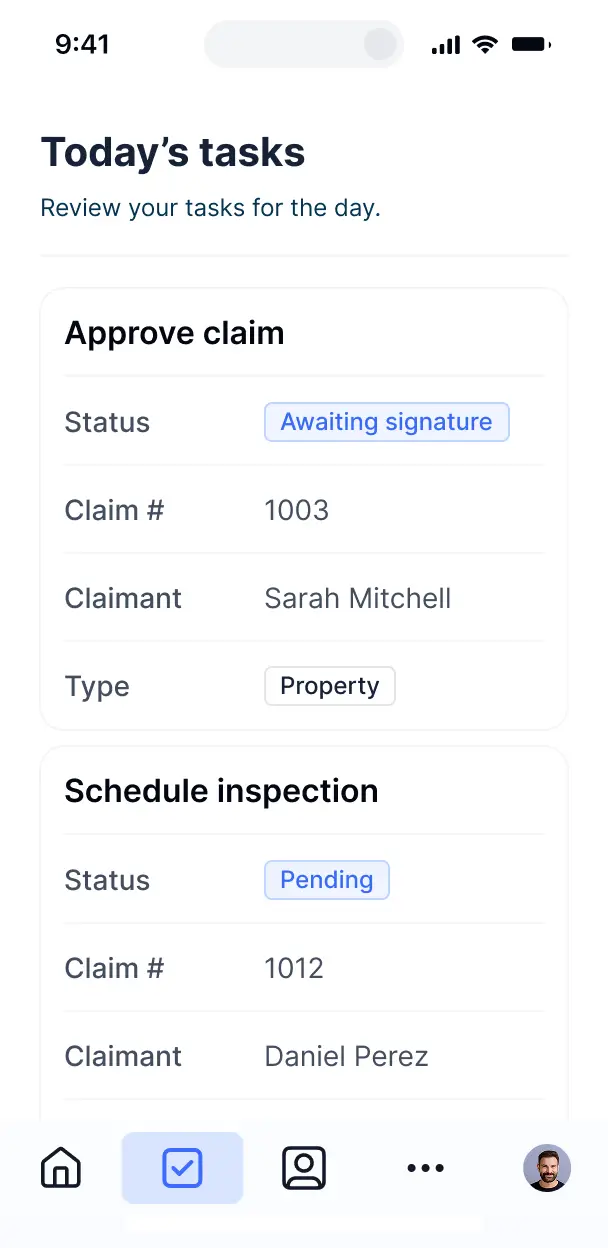

Works on any device

Access client and policy info from desktop or mobile. All apps are mobile-ready out of the box.

Easy, secure logins

Brokers and staff log in securely with Google, email, or SSO—no IT tickets or setup delays.

Security

Keep sensitive policy and client data protected with SOC2 and GDPR compliance and robust access controls.

.svg)

An AI assistant for brokers

Brokers can ask AI about policy details or client info and get instant answers right inside your CRM—no switching tabs.

Why Softr vs other software

No more one-size-fits-all tools or costly custom builds. Softr is easy to use and fully customizable, so you can launch faster, adapt as you grow, and skip the complexity of traditional software.

Easy, fast setup

Launch your insurance CRM in minutes with drag-and-drop blocks and ready-made templates.

Consolidate your stack

Add features like policy tracking, renewal reminders, or lead management as your needs change.

Flexible as you grow

Start with your CRM, then add client portals, dashboards, or forms—all in one place, no extra tools.

Build a fully custom crm for insurance brokers in minutes

Connect to your data in seconds

Integrate with your spreadsheets and databases, including Airtable, SQL, Hubspot, Google Sheets, Supabase, BigQuery, and more—in just a few clicks. Your data is always secure and in sync.

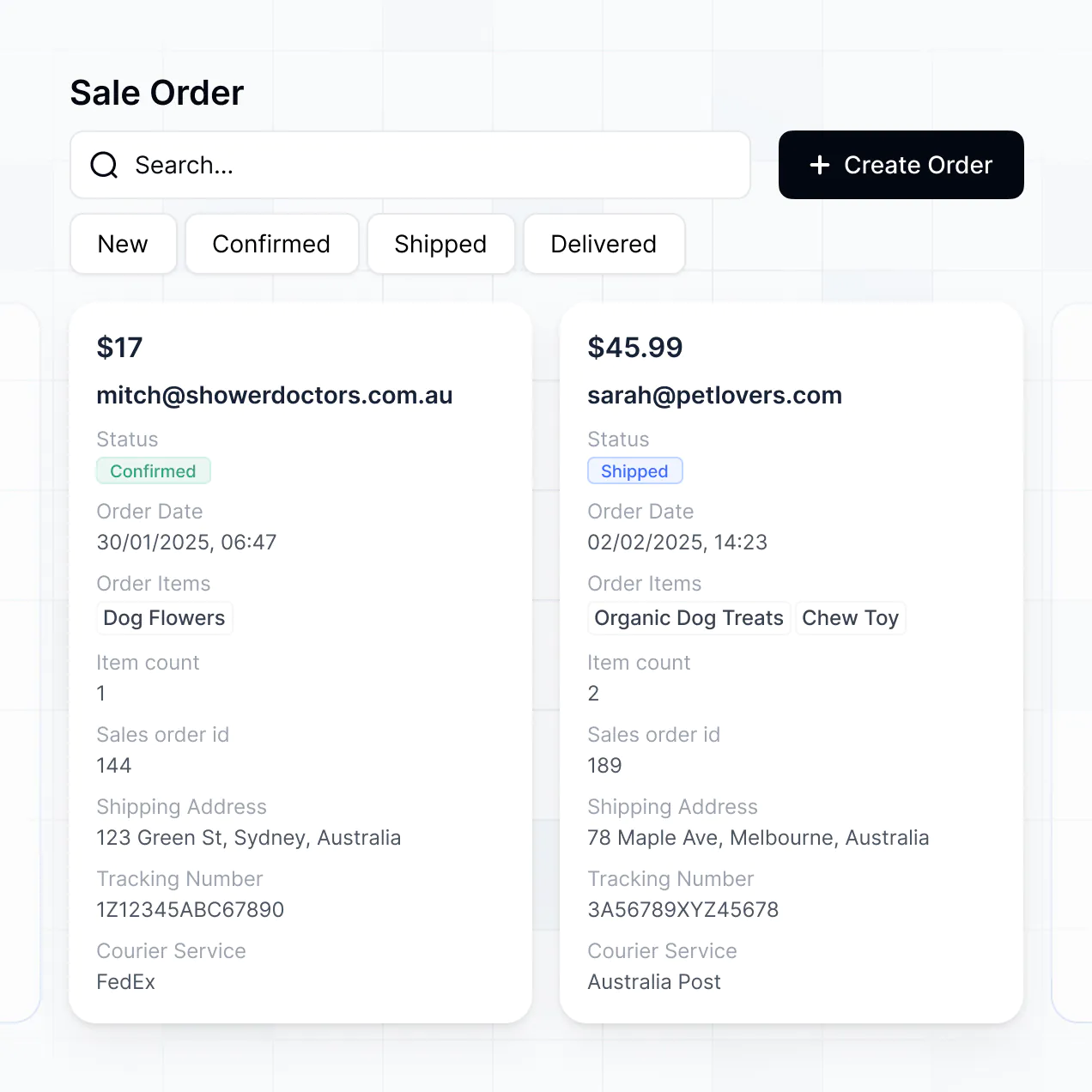

Customize layout and logic

Drag and drop customizable building blocks with various views and functionalities. Granular permissions allow you to control what data each user can access, and which actions they can take.

Publish and launch

Ship applications that your team will love in minutes or hours, instead of days or weeks. Deploy on both desktop and mobile.

250+

600+

Frequently asked questions

A CRM for insurance brokers is a secure platform where brokers can manage client details, policies, renewals, and communication—all in one place. It centralizes your client interactions, documents, and follow-ups, so you no longer need to juggle spreadsheets and emails. This makes it much easier to stay organized, track opportunities, and provide better service to your policyholders.

Softr makes it simple to build a CRM for insurance brokers that fits the needs of your brokerage. You can connect to your existing data sources—like Airtable, HubSpot, Notion, SQL, and more—and set up a workspace where brokers can access client records, manage policies, track renewals, and share important documents, all in one location.

There’s no coding required. You can start with a template or build your CRM from scratch, customize the layout, set permissions for your team, and brand the platform to match your brokerage. It’s quick to launch, easy to update, and flexible enough to grow as your business evolves. Everything stays organized and looks professional for both brokers and staff.

You can build a wide variety of features in your CRM for insurance brokers, depending on your workflow. Some common ones include:

\- Broker and staff logins – so each team member can access their own clients and policies

\- Custom dashboards – to show upcoming renewals, new leads, or outstanding tasks

\- Forms – for client onboarding, quote requests, or claims submissions

\- File sharing – so you can store and share policy documents, claims forms, or compliance materials securely

\- Search and filters – to quickly find clients, policies, or renewal dates

\- Tables, lists, and detail views – to display client lists, policy details, or communication logs

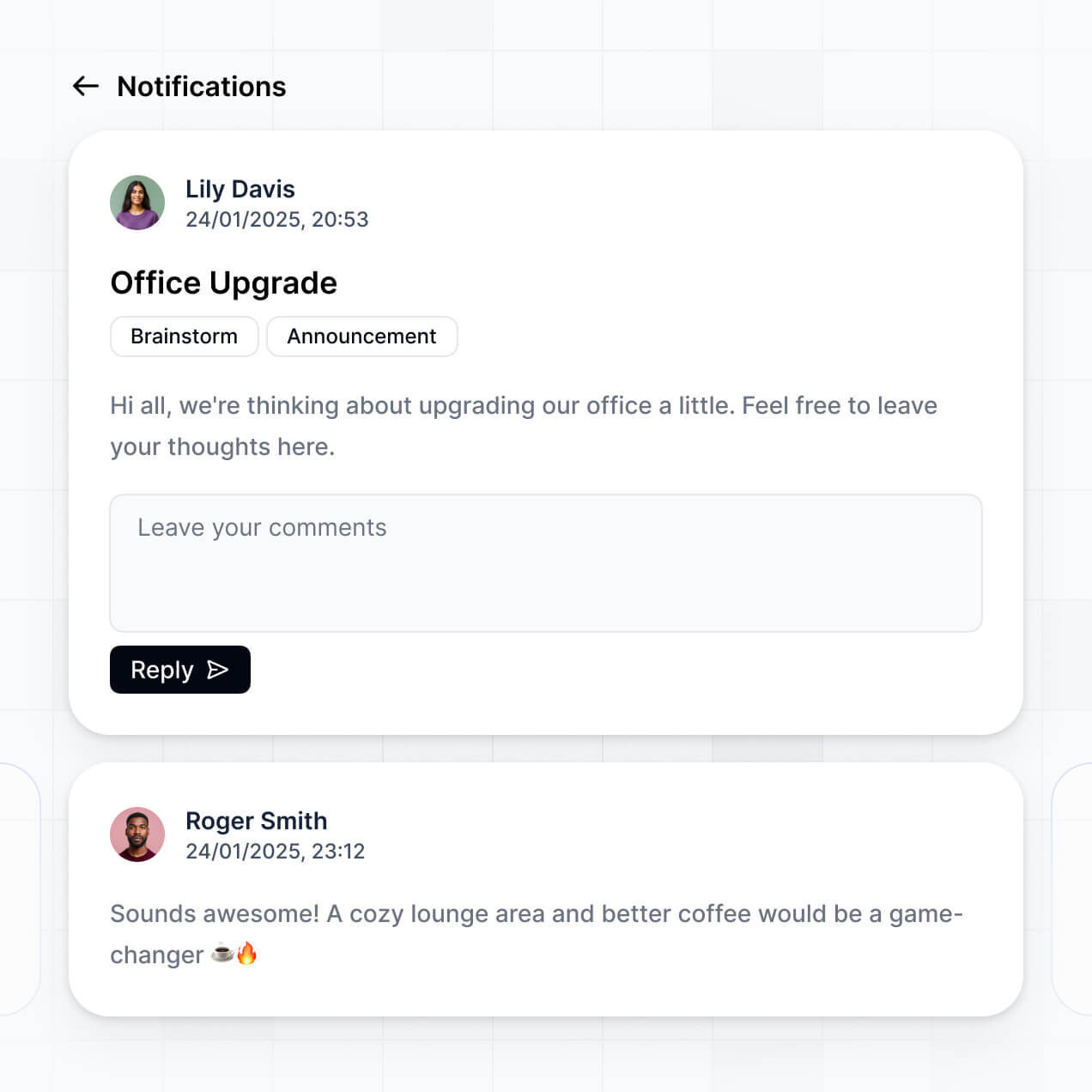

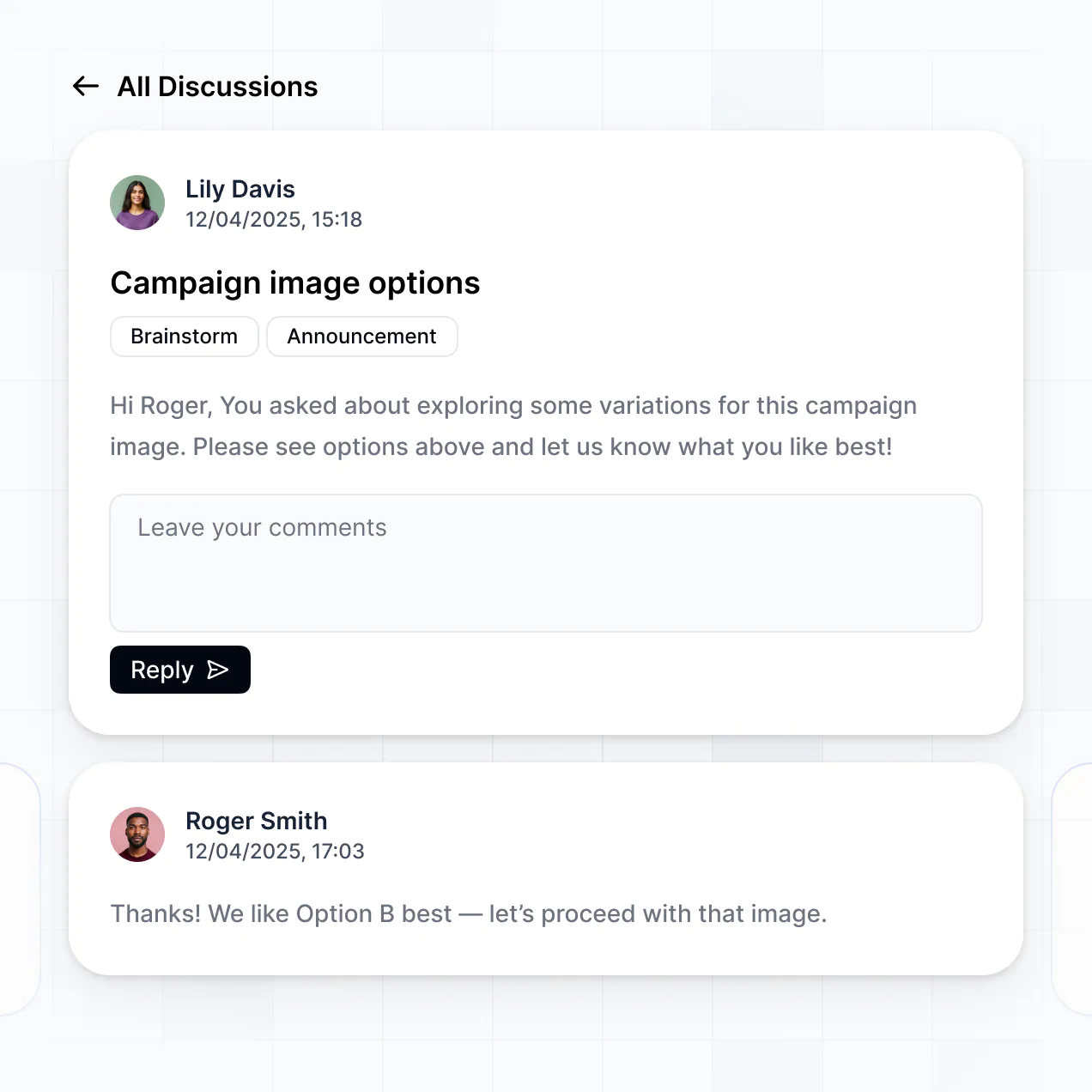

\- Comments or status updates – to keep track of conversations and next steps

\- Charts – to visualize sales performance, renewals, or claims trends

\- Calendar view – for managing appointments, follow-ups, or renewal deadlines

\- Permissions and roles – so brokers, admins, and support staff only see what’s relevant to them

All of these features can be built using Softr’s drag-and-drop blocks, so you don’t need to write any code. And if your workflow changes, you can easily update your CRM to match.

No coding is needed. You can build your CRM for insurance brokers entirely using Softr’s visual editor. Everything from the interface to team permissions can be customized without having to write a single line of code.

Yes. You can manage multiple policyholders or broker teams in a single crm for insurance brokers. Each user—whether a broker, team member, or client—only sees the content and policy data assigned to them, based on their login and role. This setup is ideal for insurance agencies managing several clients or teams from one platform.

Softr supports a wide range of data sources for your insurance CRM. You can connect to Airtable, Google Sheets, Notion, Coda, monday.com, HubSpot, Clickup, Xano, Supabase, PostgreSQL, MySQL, SQL Server, MariaDB, BigQuery, and more. You can also bring in data from other sources using the REST API.

You’re not limited to one source. You can integrate multiple data sources into your crm and display information side by side—so, for example, you can combine policy information from Airtable and client communications from HubSpot. Most sources support real-time, two-way sync, keeping your insurance data up to date automatically.

Yes, Softr gives you full control over how users interact with your insurance CRM. You can customize the layout, navigation, and content to fit your agency's brand and processes. Each page or section can be shown or hidden based on who’s logged in—so every broker, team member, or client sees only what’s appropriate for their role.

You can also set up different user roles, such as policyholder, broker, admin, or team member, and decide what each can view or edit. For example, clients can access just their policy details, while brokers and admins can manage all client records. You can create personalized views by filtering insurance data according to the logged-in user.

This level of customization is particularly useful when you’re handling multiple clients, brokers, or teams within the same crm, keeping everything organized, secure, and relevant for each user.

Yes, you can. You don’t need to import your policyholder or broker data from another source to get started with Softr. If you’re starting fresh, you can use Softr Databases, which is built into the platform and tailored to work seamlessly with your insurance CRM.

If you do have existing data in tools like Airtable, Google Sheets, HubSpot, Notion, Coda, monday.com, Supabase, or SQL, you can connect those too. Plus, the REST API connector lets you bring in data from other systems. This way, you control how all your insurance records and contacts are structured and displayed in your crm.

Yes, you can fully white-label your CRM for insurance brokers in Softr. You can use your agency’s logo, brand colors, fonts, and custom domain to make the CRM feel like a seamless extension of your brokerage. All Softr branding can be removed, so your team and insurance clients only see your company’s identity throughout the experience.

Yes, you can. Softr gives you a lot of flexibility to customize both the design and layout of your CRM for insurance brokers. You can adjust colors, fonts, spacing, and page structure to match your agency’s brand. You can choose how each page is organized, decide which blocks are visible where, and control what different users—like agents or policyholders—see when they log in.

To display your data, you can add various blocks depending on your needs:

\- Table blocks – to show structured data like policy lists, client records, or renewal schedules

\- List or Card blocks – to highlight things like policyholder profiles, insurance products, or agent tasks

\- Detail View – to display one record at a time, such as a client’s policy summary

\- Forms – for collecting client information or claims

\- Charts – to visualize portfolio mix or sales performance

\- Calendar blocks – to display key dates like renewals or appointments

If your design or content needs change later, it’s easy to make updates in Softr’s visual builder.

Softr is built with security in mind. All data is encrypted in transit (TLS) and at rest, and your CRM for insurance brokers is hosted on secure, reliable infrastructure. You have full control over who can see and do what in your CRM. You can set up role-based permissions for your agents, clients, and administrators, manage users directly within your data source, set visibility rules, and apply global restrictions to protect sensitive insurance data across the entire system.

For CRMs connected to external data sources like Airtable, Notion, or SQL, Softr doesn’t store your data—it simply displays it in real time based on your access settings. You always control your data and who can view or edit it.

Softr also follows industry best practices for authentication, access control, and ongoing platform monitoring to help keep your brokerage’s information safe.

You can get started for free. With Softr’s Free plan, you can publish one CRM app with up to 10 app users and 2 user groups, and have access to all standard data sources like Softr Databases, Airtable, Google Sheets, and more.

If your CRM for insurance brokers needs more users or advanced features, you can review how the paid plans scale here: <http://softr.io/pricing>

Softr is designed to make it easy to build fully functional, user-facing apps—like CRMs for insurance brokers, client portals, and internal tools—without any coding or reliance on developers. What sets Softr apart is how quickly you can go from concept to a working CRM, and how seamlessly it connects with your existing data sources.

Unlike some no-code platforms that focus on mobile apps (like Glide) or are more developer-oriented (like Retool), Softr is ideal for non-technical teams who want full control over layout, user experience, and permissions. You can build on top of real-time data from tools like Airtable, Google Sheets, Softr Databases, or SQL, and create secure, branded CRMs that agents, clients, and staff can access.

You can visually customize everything—from content and design to user permissions. Softr’s built-in features like user roles, forms, conditional logic, and API support mean you don’t need to piece together multiple tools to launch a polished CRM.

Yes. Softr supports a wide range of integrations so you can connect your insurance CRM to the rest of your tech stack. You can sync with tools like Stripe for payments, Intercom for messaging, and automate tasks using Zapier, Make, and N8N. Softr also supports REST API and webhooks for more advanced workflows.

Whether you need to send policy data to another system, trigger automations based on agent or policyholder actions, or display information from other insurance tools, you can build it directly into your CRM—no coding required.