First-time business owners often consider invoice management an afterthought until they experience how much work it actually takes.

Experienced accounting and finance professionals know that manually managing invoices entails a number of tasks and processes that can not only be mind-numbing (let’s be honest) but also prone to errors with significant potential financial consequences, and a cause for compliance and security concerns.

In its 2022 State of AP Report, Pinnacle Financial Partners showcases AP automation (accounts payable) as the top back-office digitization priority for organizations, with invoice approval workflows as the most popular automated AP task. However, while automation is a hot topic in the industry, the report also shows that only 16.2% of teams have implemented a fully automated AP process.

In this article, we explain why invoice automation makes sense for organizations of all sizes and industries looking to scale and optimize their financial operations and how to get started by showcasing the top 5 best invoice automation software solutions for 2024. Lastly, we will wrap up the article by showing you exactly how to get started with invoice automation in Softr.

What is invoice processing automation?

Invoice processing automation refers to using software to streamline the invoice management lifecycle, minimizing manual interaction so Accounts Payable (AP) teams can regain their time and work on more productive tasks, reducing the potential for human errors in the process.

Automation can be implemented at every step in the invoice management journey, including:

- Invoice creation: Creating invoices based on data collected with the client and/or imported from another software.

- Data extraction: Collecting invoice details (supplier name, invoice number, amount, etc) from an existing invoice to input into an accounting software.

- Reconciliation: Double-checking invoice details against internal records to ensure everything is correct.

- Stakeholder approval: Validating the invoice details and authorizing the transaction.

- Payment: Triggering payment/registering the receipt of payment.

These steps can be automated to some extent, benefiting organizations by reducing manual input. This, in turn, reduces mistakes, minimizes manual labor, and accelerates the overall process, which can be especially critical for companies working with lean logistics that require timely processing of payments going in and out.

What are the drawbacks of manual data entry?

While the main and most obvious drawback of manual entry for invoice management is how boring it is for your team (if you know, you know), there are also very factual, pragmatic business consequences to refusing to explore automation in 2024:

- Inaccuracy and errors: From missed fields to typos, mistakes are bound to happen when relying on manual data entry. These errors cost money, causing delays, extra efforts, and potential reconciliation.

- Inefficiency: Your team is better suited to conducting tasks where their humanity is valued rather than performing manual entry processes that a machine can do faster and more accurately.

- Lack of scalability: A person can process only so many invoices in a day and is likely to make more mistakes the more manual data entry they process.

- Compliance risk: A lack of automated processes will naturally make businesses more liable to fraud and increase the risk of non-compliance, as relying on human intervention throughout the entire workflow will increase the risk of non-compliance.

To summarize, manual data entry -particularly in the context of invoice management- has real consequences in terms of competitiveness for organizations. Not only will organizations refusing to digitize their practices will lag behind, but they will suffer from inefficiency throughout their operations.

This is where automation can help.

Why automate your invoicing process?

In light of the drawbacks to manual entry cited above, invoice processing automation is a no-brainer. Some of the benefits include:

- Reducing costs: Manually processing invoices takes time and costs money. In a webexpenses report, 48% of businesses surveyed claimed to handle up to 500 monthly invoices. Translated to billable hours or employee time, it adds up.

- Accelerating turnaround: As fast as an Accounts Payable professional can be, repetitive, menial tasks such as invoice processing will always be done faster by a machine.

- Minimizing errors: Human involvement in repetitive tasks will naturally lead to the occasional typo or mistake, which an automated system can prevent. This has real consequences for businesses, as 61% of late payments have been attributed to incorrect invoices.

- Ensuring compliance: Automated processes can facilitate audits and minimize fraud risks by streamlining most workflows, leaving humans to supervise and ensure compliance.

- Facilitating scalability: Last but not least, automation allows companies to scale their operations with virtually no impact on their invoice management processes.

Automation is a modern means of helping businesses spend their resources on what matters most.

While legacy companies are stuck performing menial tasks, modern organizations use technology to focus on their growth and concentrate their efforts and energy on the most impactful business areas—not copying and pasting data into their accounting software.

Why choose invoice automation over manual processing?

From a financial perspective, the main cost of manual invoice processing is human.

The entire process is a full-time job, from inputting data to ensuring accuracy, verifying information, or resolving errors. Depending on the company's size, a team of full-time employees is often required to work on all the steps involved.

Additionally, additional costs that might not be apparent initially will negatively impact an organization's practices or reputation, including payment delays, human errors, and compliance risks.

On the other hand, automating invoice processing allows your accounting team to reduce the time spent on repetitive tasks and focus instead on more important, high-value issues that require their human touch. In terms of costs, automating even parts of the workflow, such as data extraction and streamlining approval, can save hours or even days of work every month, with direct cost savings as a result, on top of drastically improving processing times.

To sum up, embracing invoice processing automation should be seen as more than a cost-saving tactic but a long-term strategic investment. While the upfront cost investment and implementation requirements of automation might seem daunting at first, the benefits regarding labor, accuracy, and efficiency will be significant. This will undoubtedly position any organization in a better place in their accounting operations.

Top 5 invoice automation software in 2025

Now that we’ve discussed the limitations of manual invoice processing and why you should consider automation, it’s time to examine some of the available options on the market.

We researched and gathered the top five Invoice automation software and will cover the pros and cons of each one, along with their key features, pricing, and which companies they are best suited for.

1. Softr: The no-code platform tailored to your needs

Softr is a no-code platform that enables businesses to automate their invoice processes by creating custom workflows tailored to their needs. With its intuitive drag-and-drop interface, Softr integrates with many different data sources and automation software, allowing users to build automated invoice generation, approval, and tracking systems without technical expertise.

It integrates with tools like Airtable, enabling businesses to manage invoicing efficiently while reducing manual data entry and errors. Softr's flexibility and scalability make it suitable for small to large companies looking for a customizable and affordable invoice automation solution.

Key features:

- Drag-and-drop interface that’s both easy to use and powerful

- Integration with database tools like Airtable, Notion, monday.com, HubSpot, SQL and Google Sheets.

- Integration with automation software like Zapier and Make

Pros:

- Easy to use, customizable workflows

- Affordable pricing

- Scalable for businesses of all sizes.

- Engaged and vibrant user community

- Responsive and expert customer support

Cons:

- Limited advanced automation features without third-party integrations.

Pricing: Free plan available; paid plans start at $49 /month.

Best suited for: Any type of business, including enterprises, looking for flexibility and scalability.

Softr provides companies of all sizes with hyper-customizable invoice management software that can meet the needs of every organization, from solopreneurs and startups to global enterprises. The expert customer support is backed by a vibrant user community, with whom we communicate closely to improve our platform consistently based on feedback and experience.

2. Tipalti: A premier solution for global enterprises

Tipalti is a global payment automation platform that simplifies invoicing and payments. It offers valuable capabilities for companies working globally, such as multi-currency support or international compliance features.

Key features:

- Automated invoice capture, approval workflows, tax compliance, and global payments.

Pros:

- Robust features for global invoicing

- Multi-currency support

- Tax compliance capabilities.

Cons:

- The steep learning curve for small businesses

- Expensive for smaller teams.

Pricing: Starts at $129/mo.

Best suited for: Enterprises and businesses with global invoicing needs.

3. Stampli: A collaborative solution focused on accounts payable

Stampli is a collaborative AP automation platform designed to streamline invoice processing. The solution aims to become your go-to AP tool, syncing with the rest of your stack and offering comprehensive features for AP teams.

Key features:

- AI-powered invoice capture

- Real-time collaboration and approval workflows

- Integration with ERP systems.

Pros:

- Easy collaboration with finance teams

- AI-driven efficiency

- User interface.

Cons:

- More suited for larger organizations

- Can be expensive for small businesses.

Pricing: Available on request.

Best suited for: Medium-to-large organizations focusing on collaboration and invoice approval processes.

4. AvidXchange: AP automation for mid-size businesses

AvidXchange is an invoice and payment automation software focused on simplifying AP workflows.

Key features:

- Paperless invoicing

- Automated approval workflows

- Payment processing

Pros:

- Highly customizable

- Strong integration with accounting systems

- Reduces paper invoicing

Cons:

- Expensive

- Some features can be complex for smaller teams

Pricing: Quote-based plans

Best suited for: Mid-sized businesses and enterprises looking for robust AP automation.

5. QuickBooks Online: A full accounting suite for small businesses

Quickbooks Online is a popular accounting platform with built-in invoice automation features. Packed with features, it’s a good fit for small businesses or entrepreneurs interested in a one-stop shop for all their accounting needs.

Key features:

- Invoice creation

- Automatic reminders

- Recurring billing

- Integration with payments

Pros:

- Seamless integration with accounting solutions

- Easy to use

- Ideal for small businesses

Cons:

- Limited scalability for larger organizations

- Fewer advanced features for approval workflows

Pricing: Free trial, then starts at $9.50/mo.

Best suited for: Freelancers and small businesses seeking easy invoicing and accounting solutions.

How to use Softr as an invoice automation software

The invoice management process involves a lot of different tasks, many of which can be automated to some extent. Some of the steps your AP team could consider automating include:

- Invoice generation

- Expense and time tracking

- Automated payment reminders

- Approval workflows

- Sales tax and discount application

- Invoice tracking and reporting

- Payment follow-up

To start from the beginning and give you a concrete example, let’s examine how you could automate your invoice creation process with Softr.

In this section, we show you how to easily create a front-end interface that your sales team on the field can use to enter details from a deal, which will be automatically converted into an invoice and saved in a dedicated folder for your AP team.

Our platform allows you to work with numerous data sources and integrations to fit your internal tech stack and requirements. For this example, we chose to work with Make and Google Docs, but check out another one of our articles to see how to share invoices with customers automatically.

Follow the guide!

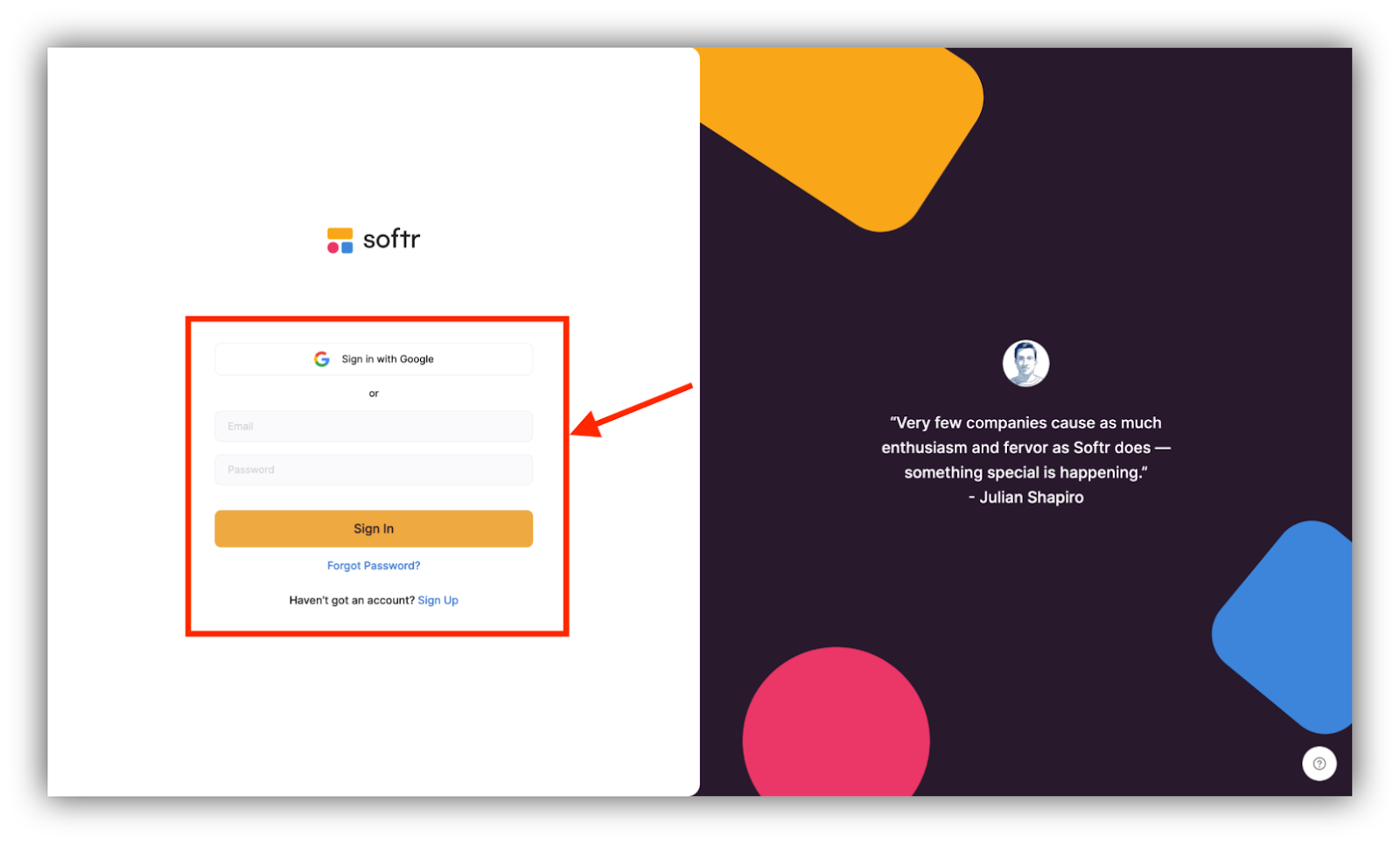

2) Click on “Create new”

Create a new application that will serve as the front end to collect invoice information.

3) Select “Start from Scratch”

Softr allows you to create apps with data imported from an existing data source, start with a pre-built template, or even generate it with AI. For this example and to keep it as basic as possible, let’s start from scratch

4) Click on “Create application”

The page that we’re interested in in this example is the form.

5) Click on “pages”

Let’s look at the pages available on your app.

6) Select the “form” page

The form will be the point of entry for invoice data.

7) Select your form

Let’s customize our Softr form.

8) Click on “Where would you like to send responses?” and select “Make” from the dropdown

There are several options, but let’s go with Make, a powerful automation software, for this tutorial.

As soon as you select Make, a series of steps will appear, explaining how to proceed. We will also break them down here to clarify our specific use case.

10) Click on “Create a new scenario”

This scenario will serve as the automation backbone of our project.

11) Select “Custom Webhook” from the list of apps

It is listed under the “Webhook” app.

12) Select “Add” to create a new hook

Let’s connect Softr and Make to create our automation.

13) Name your hook and press “Save”

Give it a name you’ll remember, in case you start creating many of them.

14) Select “copy address to clipboard”

Next, we’re going back to Softr.

15) Paste in the “Send to Make” field in your Softr app

Your app and Make are now connected.

16) Click on “Click here to send data”

Let’s try the connection.

17) In Make, ensure the interface displays “Successfully determined,” then press “Ok”

If it’s not the case, repeat the previous steps after clicking on “Re-determine data structure.”

18) Back to Softr, select “Questions” in your form settings

Let’s determine what we want to include in our invoices.

19) Customize your form with the necessary fields

Customize your form so it has all the relevant fields for your invoice. This data will be forwarded to generate invoices automatically, so think of everything (you will be able to edit and iterate later). Here, we created each field from scratch and included:

- Salesperson name

- Client name

- Company name

- Product/solution purchased

- Cost

- Quantity

- Billing Address

20) Publish your Softr app

We must test if the automation is working correctly with a live app.

21) On Make, click on “Run Once”

Your Make automation will listen and wait for you to submit a live form.

22) In your live form, enter some data and press “Submit”

To find your form, if you haven’t customized your app or domain name, enter your domain name in your browser and add “/form” at the end.

23) In Make, verify that the data has been received

If that’s not the case, go back to Softr and ensure that your form is correctly configured before going further. The next step is to add Google Docs into the mix.

24) Create a Google Doc for your invoice with the same fields

This Google Doc will serve as a template. Every time someone fills out the form in your app, a Google Doc will be generated. Make it as personalized as you’d like, but remember to include all the fields you created in the previous step, and for each one to include a smart field, between brackets like such: {{example}}. This will be replaced by the answers provided in the form.

For example, in our case, it looks like this:

25) In Make, select “Add another module”

Let’s add Google Docs to our scenario.

26) From the list of apps, select Google Docs and the “Create a document from a template” trigger

Every form answer will generate a new document based on the Google Doc template you created previously.

27) Configure your Google Doc module

In the Google Doc module on Make, log in to your Google Account, and you can now configure the module to receive the information you’ve prepared so far:

- Document ID: Select the template you’ve set up previously

- Values: Match all the form data in Softr with the form data in your Google Docs. Note that you can combine and format data in Make and even make calculations (quantity*cost, for example, to get a total for your invoice).

- Title: Use smart fields to create a title for each new document. For example “{{company name}} ({salesperson}}, {{date}}”. Everything to make sure the content of the document is clear.

- New document’s location: Lastly, on your drive, pick the destination of these newly generated invoices. Ideally, they should go straight to your AP team.

Once everything is set, press “Ok.”

28) Run one last test and check out your generated invoice

Click “Run Once” on Make and fill out another form on your live site. Returning to your Google Drive, you’ll find a newly generated invoice with the details you filled out in the form. If something is missing, return to the previous steps and ensure everything is mapped out correctly.

29) Turn on your Make scenario

Your automation is ready to go live!

Congratulations! Going forward, you can share your public Softr app with your sales team in the field, and every time they enter details from a deal, an invoice will be generated and sent to your AP team for approval.

The example is quite rudimentary, but you can imagine how sophisticated it can get. The invoice can easily be customized and enriched, the Softr app can be extended to be shared with other teams for quotes or bills, and the next steps in the AP chain can also be automated, reducing the time and effort it takes to generate and process invoices daily.

Invoice processing automation should be a no-brainer for you by now. Choosing the right invoice automation software will be a crucial decision in your accounting operations, and we hope this guide helped you decipher some of the options available to you more clearly.

Our platform's flexibility, reliability, and performance make Softr the right choice for most organizations. Take advantage of our free trial to see for yourself.

What is Softr

Join 700,000+ users worldwide, building client portals, internal tools, CRMs, dashboards, project management systems, inventory management apps, and more—all without code.